The crypto market is one of the closely watched sectors in India, which is growing rapidly. Beyond simple trading and holding of tokens, traders are now increasingly investing in crypto derivatives, especially crypto options trading.

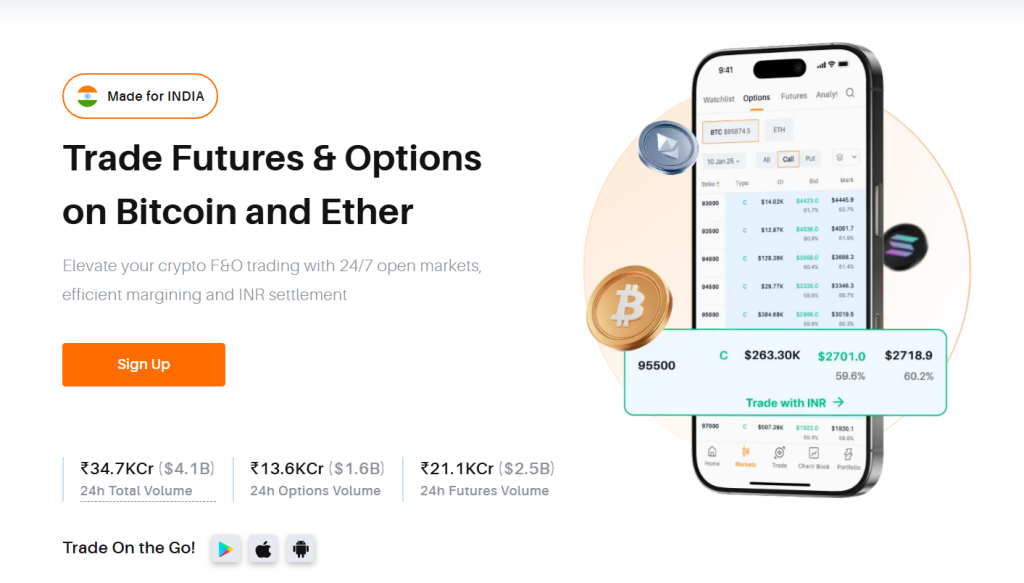

In this post, we’ll discuss why Delta is one of the leading platforms in the space and how it’s helping new traders (and even experienced ones) confidently navigate the volatile crypto market.

Understanding Crypto Options

Crypto options are contracts that grant the buyer the right, but not the obligation, to buy (a “call” option) or sell (a “put” option) a cryptocurrency at a predetermined price on or before a specific date. The seller of the option is obligated to fulfill the contract if the buyer chooses to exercise their right.

Delta Exchange offers European-style options for Bitcoin (BTC) and Ethereum (ETH), which can only be exercised at the expiration date. These are available with various strike prices and expiry dates, catering to different market outlooks.

Before diving into specific strategies, it’s crucial to understand the inherent risks and have a solid plan. Key considerations include a thorough understanding of the strategy, the associated trading costs, and the prevailing market conditions.

Factors to Consider Before Choosing Crypto Options Trading Strategies

Before choosing a trading strategy, it’s vital to assess these key points:

- Know Your Strategy: Fully grasp how it operates, including its potential profits, risks, and influencing factors like volatility.

- Use Risk Tools: Ensure your chosen platform provides risk management features to protect your capital.

- Factor in Costs: Be mindful of how trading fees can impact your returns, particularly with high-frequency strategies. Take a look at Delta’s crypto trading fee details.

- Analyze the Market: Stay informed about market trends and news, as these will influence your strategy’s success.

Popular Options Trading Strategies

Here are some of the best strategies you can employ on Delta Exchange:

Covered Call

This strategy involves holding a cryptocurrency like BTC or ETH and selling a call option on the same asset. It’s best suited for a neutral to bullish market, allowing you to earn income from the option premium while potentially capping some upside gains.

On Delta Exchange, covered calls can be part of a balanced risk management in crypto approach.

Bull Spread

A bull spread, which can be created with either calls or puts, is designed to profit from a moderate price increase while minimizing risk. With calls, you can buy BTC or ETH at a lower price and sell at a higher price. Puts work oppositely but still benefit from a rise. This strategy offers controlled exposure with a defined profit and loss potential.

Long Strangle

If you anticipate a significant price volatility in a cryptocurrency but are unsure of the direction, the long strangle is a suitable strategy. It involves buying an out-of-the-money call and an out-of-the-money put with the same expiry but different strikes. This strategy has the potential for unlimited profit if the market makes a large move, while the maximum loss is limited to the premium paid for the options.

Effective Risk Management on Delta Exchange

Successful options trading hinges on robust risk management. Delta Exchange provides several tools to help traders protect their capital:

- Demo Account: Practice your strategies in a risk-free environment with a free demo account before committing real funds.

- Diversification: Avoid relying on a single strategy to reduce your overall risk exposure.

- Stop-Loss Orders: Automatically exit a position when it reaches a certain price to minimize potential losses.

- Strategy Builder: Analyze potential profit and loss scenarios with a strategy builder and understand the breakeven points of your trades before execution.

The Bottomline

Trading crypto options presents a versatile toolkit for navigating both upward and downward trending markets. By strategically combining appropriate trading approaches with robust risk management practices, traders can unlock diverse market opportunities aligned with their individual risk tolerance. The key lies in familiarising yourself with these strategies and understanding how Delta Exchange works – offering the right platform to test and refine them.

With INR-supported transactions, affordable lot sizes, and 24/7 customer support, Delta ensures you have both the tools and the confidence to explore crypto options effectively.

Disclaimer: Investing in cryptocurrency carries a high risk of market volatility. Kindly do your own research before investing.